All Categories

Featured

Table of Contents

The are entire life insurance coverage and universal life insurance policy. The cash money value is not included to the fatality advantage.

The plan lending passion price is 6%. Going this path, the rate of interest he pays goes back right into his plan's cash money value instead of a financial establishment.

Infinite Banking Agents

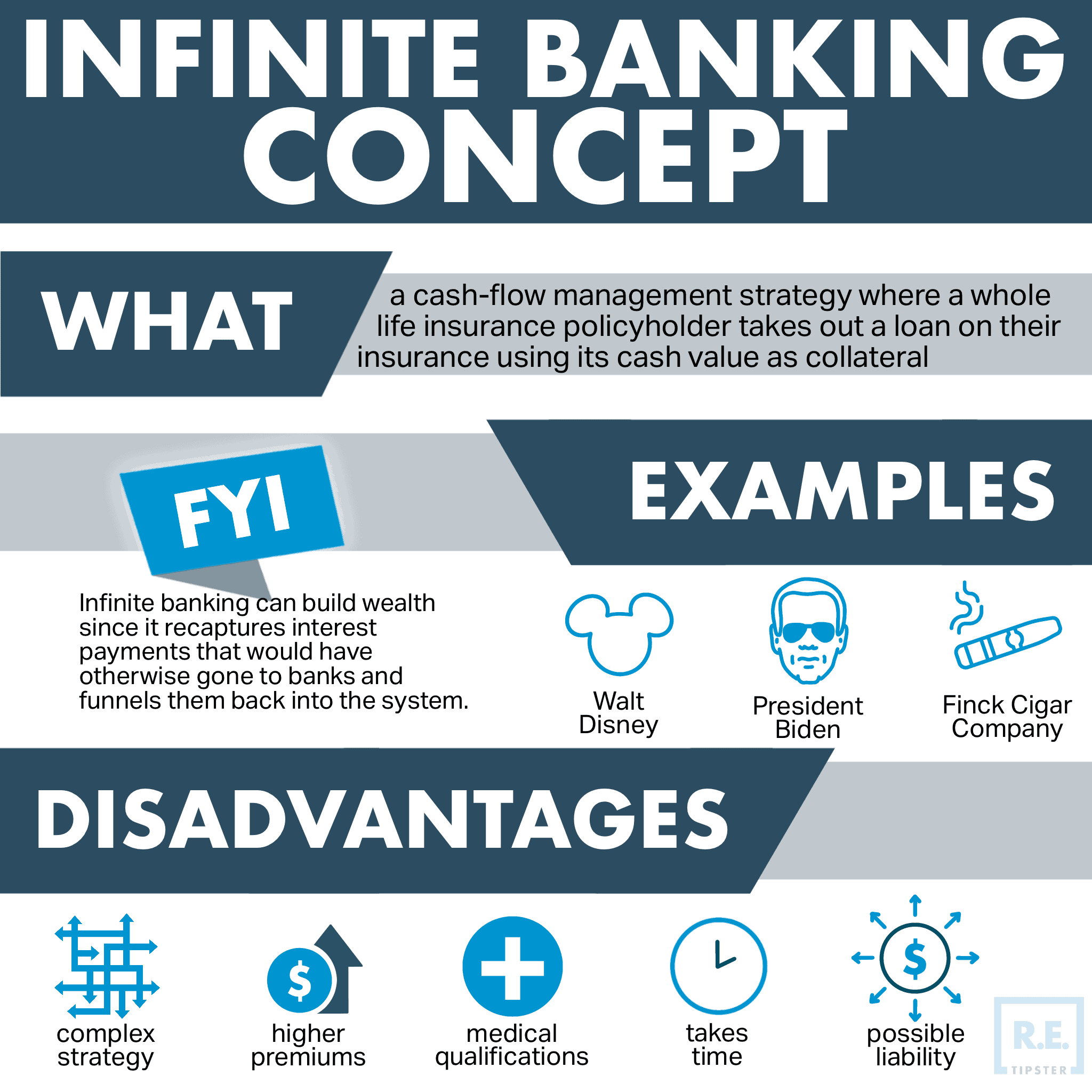

The idea of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a finance expert and fan of the Austrian college of business economics, which promotes that the worth of products aren't explicitly the result of traditional financial frameworks like supply and demand. Instead, individuals value money and products in a different way based upon their economic standing and needs.

One of the pitfalls of typical financial, according to Nash, was high-interest prices on finances. Long as banks set the rate of interest rates and lending terms, people didn't have control over their own riches.

Infinite Financial needs you to possess your monetary future. For goal-oriented individuals, it can be the ideal financial device ever. Right here are the benefits of Infinite Banking: Probably the single most advantageous aspect of Infinite Financial is that it improves your capital. You do not require to undergo the hoops of a typical financial institution to obtain a financing; just request a policy lending from your life insurance policy firm and funds will certainly be made readily available to you.

Dividend-paying entire life insurance policy is extremely low threat and provides you, the policyholder, a terrific offer of control. The control that Infinite Financial offers can best be organized into two categories: tax benefits and asset defenses - whole life infinite banking. Among the factors whole life insurance is perfect for Infinite Banking is just how it's strained.

Bank On Yourself Ripoff

When you make use of whole life insurance coverage for Infinite Financial, you enter right into an exclusive contract in between you and your insurance policy business. These securities may vary from state to state, they can consist of protection from possession searches and seizures, defense from reasonings and security from creditors.

Entire life insurance policy policies are non-correlated properties. This is why they function so well as the economic structure of Infinite Banking. No matter what occurs in the marketplace (supply, genuine estate, or otherwise), your insurance coverage retains its worth. A lot of individuals are missing out on this vital volatility barrier that assists safeguard and expand riches, instead breaking their money right into two pails: savings account and investments.

Whole life insurance policy is that third container. Not only is the rate of return on your entire life insurance plan ensured, your death benefit and costs are also assured.

Here are its main benefits: Liquidity and accessibility: Policy finances give instant accessibility to funds without the limitations of standard bank fundings. Tax obligation efficiency: The money worth expands tax-deferred, and policy financings are tax-free, making it a tax-efficient device for constructing wealth.

Be Your Own Banker Concept

Property defense: In several states, the money value of life insurance coverage is protected from lenders, adding an additional layer of economic safety. While Infinite Banking has its values, it isn't a one-size-fits-all solution, and it features considerable downsides. Right here's why it might not be the most effective approach: Infinite Financial often needs complex policy structuring, which can puzzle insurance policy holders.

Picture never having to worry about financial institution fundings or high rate of interest once again. What if you could obtain cash on your terms and develop wealth at the same time? That's the power of infinite banking life insurance. By leveraging the money value of entire life insurance policy IUL policies, you can expand your wealth and obtain money without counting on traditional banks.

There's no collection loan term, and you have the freedom to pick the settlement routine, which can be as leisurely as paying back the finance at the time of fatality. This adaptability includes the maintenance of the financings, where you can choose interest-only repayments, maintaining the financing equilibrium flat and manageable.

Holding cash in an IUL dealt with account being attributed interest can often be far better than holding the money on deposit at a bank.: You have actually constantly dreamed of opening your own bakeshop. You can borrow from your IUL plan to cover the first expenses of leasing a room, purchasing tools, and hiring personnel.

Nelson Nash Becoming Your Own Banker Pdf

Personal financings can be gotten from traditional financial institutions and cooperative credit union. Here are some bottom lines to take into consideration. Charge card can supply an adaptable method to borrow cash for really temporary durations. However, obtaining money on a credit report card is generally very pricey with yearly percentage rates of passion (APR) usually reaching 20% to 30% or even more a year.

The tax therapy of plan finances can differ significantly depending on your country of house and the certain terms of your IUL policy. In some regions, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan financings are normally tax-free, providing a significant advantage. In various other jurisdictions, there may be tax obligation effects to think about, such as potential tax obligations on the finance.

Term life insurance policy only gives a death benefit, without any type of cash money value buildup. This implies there's no cash value to borrow against.

However, for car loan police officers, the extensive regulations imposed by the CFPB can be viewed as troublesome and limiting. First, lending officers commonly suggest that the CFPB's regulations produce unnecessary red tape, leading to even more documents and slower finance handling. Rules like the TILA-RESPA Integrated Disclosure (TRID) regulation and the Ability-to-Repay (ATR) demands, while focused on safeguarding consumers, can bring about delays in closing offers and increased functional prices.

Latest Posts

Infinite Banking Center

Infinite Banker

Becoming Your Own Banker : The Infinite Banking Concept ...